Unravelling the magic of Pendle Finance

Exploring an approach to optimising DeFi yield strategies

Contents

1.1 Mechanisms

1.2 Key Stats

1.4 Fundraising

1.5 Evolution

2.2 Physical Token

2.3 Yield Token

2.4 PT Trade

2.5 YT Trade

2.6 LP Trade

3.1 Impact on the DeFi ecosystem

3.3 Revenue

1. Introduction

An unprecedented revolution is currently reshaping the financial industry. The emergence of decentralised finance (DeFi) has paved the way to a bold new realm of endless possibilities and innovations. DeFi embodies a unique composability feature, characterised by a stack structure built on pre-existing elements like decentralised exchanges and money markets. This fusion of novel components is fuelling a surge of fresh opportunities, propelling the evolution of a sophisticated and streamlined financial ecosystem.

Yield is the golden thread that weaves together different elements in DeFi. From liquidity provision and inflationary incentives to lending capital and protocol fees, yield is generated through various means. By recognising the greater value of present money, capturing future yield in advance becomes the ultimate financial game-changer. In traditional markets, the exchange of present and future value is facilitated as trading yields take flight. Swapping floating interest rates for fixed, or vice versa, can empower savvy market players to hedge against downturns or ride the wave of long-term yield speculation.

As multi-faceted developments continue to push forward, more and more innovative DeFi protocols are surfacing. Some like Pendle Finance are aiming to capture the sector’s value proposition by tokenising future yield, creating a new market within DeFi. Drawing its name from the witch village in England, Pendle has been working its magic on the way we interact with yields. Yet, instead of cauldrons and potions, advanced algorithms and smart contracts are harnessed to cast spells of prosperity for users.

1.1 Mechanisms

Pendle separates ownership of yield-bearing assets and their corresponding yields, empowering DeFi participants to sell future yield for immediate liquidity while preserving ownership of the asset. It also enables speculators to gain pure yield exposure, serving as a capital-efficient form of leverage without liquidation risks.

As the the process of tokenising future yield involves complex mechanisms, Pendle’s time-dependent automated market makers (AMMs) is noteworthy. This feature provide robust support for tokens that exhibit time-decaying attributes, marking a significant breakthrough in DeFi. Moreover, these AMMs equip developers with tools to support option as well as bond-like pricing and valuation.

1.2 Key Stats

Token Price: $0.411 (at time of writing)

Holders: 3,587

Market Cap: $39.31 million

Fully Diluted Valuation: $94 million

Trading Volume (24H): $274k

Total Supply: 235,890,444

Circulating Supply: 154,405,333

TVL: $70.4 million

1.3 Community Engagement

Twitter: 32.7k followers

Discord: 9.4k members

1.4 Fundraising

Pendle Finance raised $3.7million of seed funding in a deal led by Mechanism Capital in April 2021. Other investors included CMS Holdings, Crypto.com Capital, Spartan Group and Hashkey Capital.

1.5 Evolution

2. Understanding Pendle

Pendle allows holders of yield-bearing assets to strip and trade future yield using established money markets, such as AAVE and Compound. The protocol achieves this by cleverly splitting yield-bearing assets into two categories: Physical Tokens (PT) and Yield Tokens (YT).

This structure empowers the platform’s users to tokenise and sell their valuable yields as YT tokens. This ensures secure returns by converting variable-rate future yields into fixed-rate present values. Additionally, traders can engage in future yield volatility without locking up their base assets. Through the sale of YT tokens, users can partake in an interest rate swap that allows them to exchange floating-rate for fixed-rate present value akin to a zero-coupon bond.

2.1 Yield Tokenisation

Users initiate the process by depositing their yield-bearing assets, such as stETH, into Pendle. These assets are subsequently wrapped into Standardised Yield (SY), a token standard that streamlines interactions with Pendle's yield generation mechanism. Once deposited, Pendle divides the yield-bearing asset into two elements:

the PT representing the original asset's principal value

the YT granting access to future yield entitlements

Let’s use a simple analogy to explain the protocol’s mechanisms. Imagine you have an apple tree and you bring it to the enchanted garden of Pendle. A magical spell called Pendle Protocol is cast on your apple tree, transforming it into two entities:

The Tree (PT): It resembles the original apple tree but without the apples, representing the intrinsic value of owning an apple tree. You can sell this tree to someone seeking ownership of their own apple tree.

Future apples (YT): This mystical basket captures all the apples that the tree will yield over a specific period. You have the choice to keep this basket if you anticipate a bountiful harvest, or sell it to someone who foresees an even greater abundance.

Within the Pendle garden, various trees (i.e. yield-bearing assets) like orange, pears, and papaya flourish. Each tree is divided into its individual from and its future fruits. Through the magical spell of SY standard, everyone in the garden can trade their trees and future fruits with each other in the same way.

Let’s relate this back to Pendle, taking cDAI as an example:

Above is essentially how the yield tokenisation process works.

💡 PT Price + YT Price = Underlying Asset PriceLet’s further break down the different mechanics of each individual token and what users can do with them.

2.2 Physical Token (PT)

1 PT grants users the ability to redeem 1 unit of the underlying asset at maturity. Consider the example of stETH, a token representing your stake in the Ethereum network. The PT will represent the fundamental value of your stETH, signifying the amount of stETH you originally deposited. By holding 1 PT-stETH, users can exchange it for 1 ETH worth of stETH in the future. Note that PT does not encompass the yield generated from staking ETH; that aspect is represented by YT.

2.3 Yield Token (YT)

YT represents the yield generated by an asset over time. Each YT entitles users to receive real-time yield on each unit of the underlying asset until maturity. Consider an instance where holding 10 YT-stETH allows users to claim the entire yield from 10 ETH staked in LIDO. The yield is determined by the underlying annual percentage yield (APY) on Pendle.

For those familiar with zero-coupon bonds and stripped yields, parallels can be drawn. As those who are not acquainted with these concepts, we will elaborate on potential trading strategies in the next section.

2.4 The PT Trade

Holding till maturity: Users have the option to trade PT on the Pendle AMM, where the price of PT is dictated by market dynamics of demand and supply. Pendle ingeniously separates the yield’s value from the principal, enabling the PT to be purchased at a discount compared to the underlying asset’s actual value.

To illustrate:

Here’s an illustration to show how you can get PT-cDAI at a lower price than the regular cDAI token. Based on the example, the fixed APY is 11% (0.1DAI / 0.9DAI *100). This fixed yield obtained from buying and holding the PT relies on the market PT price. As such, it is advantageous for users to buy PT when it is priced lower to secure a higher fixed yield.

To assess if PT is priced attractively, users need to compare their projected average future yield with the current fixed yield. If they anticipate a future yield of 5% while the current fixed yield is 6%, it implies that the PT is undervalued. Thus, users should consider buying it. A simple estimate of the future yield is the current underlying APY, which reflects the APY generated in the underlying protocol. Assuming constant market conditions until maturity, the underlying APY should align with the future APY.

Early selling of PT: Users can choose to sell the PT before maturity if they wish to reallocate their capital. Otherwise, they can capitalise on a substantial increase in the PT’s price, securing early profits.

Suppose this hypothetical situation:

1 Jan 2023 → 1 ETH = $1,000

You bought 1 PT-stETH at 0.9stETH with a 1 year maturity. Hence, your cost would be $900.

3 months later, 1 April 2023 → 1 ETH = $1,500

If you anticipate a decline in the dollar price of ETH upon maturity in 9 months, you can choose to sell your PT earlier rather than redeeming it. This could potentially result in higher profitability.

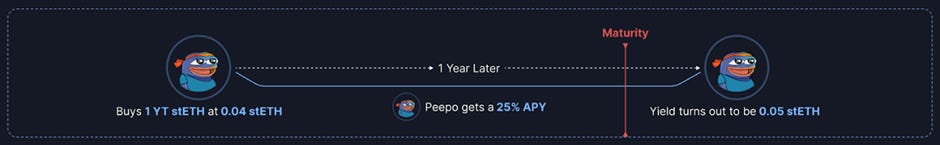

2.5 The YT Trade

To grasp this strategy, remember that buying YT is essentially longing yield - a bullish view. So when should you long yield? When you think that the average future APY will surpass the implied yield.

💡 Implied yield refers to the expected rate of return on an investment, such as a bond or fixed-income security. It reflects the yield or interest rate anticipated by the market based on the current market price of the investment.A simple estimate of the average future APY is the current underlying APY. If it is lower than the market implied yield, a profitable trade opportunity exists.

💡 Profit = Average Future APY - Cost of YTLet’s consider an example:

You have 4 stETH and if you stake them on Lido with an APY of 4%, you would receive 1.04 stETH at maturity.

The profit would amount to 0.16 stETH.

However, you believe that the average future APY will exceed the current implied APY. In this case, buying YT (stETH) would be a wise strategy to long yield. You purchase 100 YT with a cost of 4stETH, where the current implied APY is 4% and the underlying APY is 5%. After one year, your prediction proves accurate, and the yield turns out to be 5%. The value of those 100 YT is now worth 5 stETH, resulting in a profit of 1 stETH.

In this example, we can see that buying YT when anticipating an increase in yield is an effective method to multiply profits. Due to the volatility of the crypto market and fluctuating APYs, strategic timing of buying and selling PT and YT can potentially yield greater profits.

Ultimately, it all comes down to your perspective on the average future APY. Will it go up or down?

2.6 The LP Trade

Users can choose to provide liquidity for Pendle pools and receive the following in return:

Fixed Rate from PT

Protocol rewards from underlying token

Swap fees

PENDLE incentives

3. Unique Value Proposition

There are two key benefits provided by Pendle:

Managing yield volatility

Benefits of trading future yield

DeFi platforms often provide access to current yields, but they can be unpredictable and subject to market fluctuations as well as crypto developments. Pendle improves upon this by tokenising future yields, giving users greater control and certainty over their expected returns.

By trading future yields, users can capitalise on anticipated yield increases or hedge against potential declines. For instance, if an investor predicts a decrease in ETH yield, they can trade YT at a more advantageous price prior to the expected decline. This presents investors with a unique opportunity to leverage future yields, maximising profits in bullish markets and safeguarding against yield risks in bearish conditions.

3.1 Impact on the DeFi ecosystem

Pendle revolutionises the DeFi ecosystem with its impactful value proposition, manifesting in two major ways:

Enhanced yield generation

Improved risk management

Through customisable yield exposure and hedging capabilities, Pendle empowers users to optimise their yield strategies. This could potentially yield higher overall returns. By mitigating risks, Pendle adds a layer of stability to investors’ portfolios and safeguards against losses linked to volatile yields. This promotes a more secure and resilient DeFi ecosystem.

3.2 Tokenomics and Governance

Pendle's governance relies on vote-escrowed (ve) PENDLE tokens. By locking these tokens for a certain duration, the platform achieves a greater degree of decentralisation and provides a wide array of user incentives.

3.3 Revenue

Pendle implements two fee structures:

Protocol fees: 3% of the interest generated from yield-bearing tokens goes to Pendle’s treasury.

Swap fees: Pendle’s AMM charges a 0.35% fee on all swaps, distributed to LPs (0.3%) and Pendle’s treasury (0.05%).

Pendle also collects a fee from all yield accrued by YT, which is distributed to vePENDLE holders. These holders can vote for liquidity incentives to be allocated to different pools. They are entitled to 80% of swap rewards from their chosen pools. Holding vePENDLE while providing liquidity into an LP boosts a user’s PENDLE incentives and LP rewards.

4. Challenges

The primary challenge for Pendle is achieving mass adoption due to the complex nature of yield trading and its associated strategies. Users must have a deep understanding of yield trading and market conditions to fully optimise Pendle’s features and profits. This complexity can be overwhelming, hindering adoption especially for newcomers to crypto.

Pendle is also similar to bonds or options in terms of leveraging market insights for investment optimisations. Thus, the platform’s innovative features may be challenging for investors without specific market views.

To overcome this, Pendle could prioritise user education and simplify the trading experience for wider acceptance. Making the protocol more intuitive and user-friendly will increase the chances of mass adoption, bringing the benefits to tokenising future yield to a broader audience.

5. Conclusion

Pendle Finance revolutionises yield trading, enabling users to optimise yield exposure and hedge against risks with its unique value proposition and commitment to innovation. The platform has the potential to define the future of DeFi , offering users novel ways to engage and benefit from yield volatility.